San Francisco-based Brio Financial Group, during the firm’s 20th Anniversary year, was selected as a finalist for the prestigious InvestmentNews‘ Excellence in Diversity & Inclusion Awards. Judges for the honor shared that Brio was chosen because of its “success in spreading the word about the importance of diversity and inclusion and how those efforts have inspired others from diverse backgrounds to succeed in the financial advice profession.”

Established in 2001, Brio excels at handling the complex and unconventional financial situations that often affect LGBTQ individuals, couples, and families. Their team members are quick to add, however, that “you don’t have to be gay or complicated to be accepted” as a client or as part of their prestigious team.

During this year, when the fight for social justice and equality has renewed strength and importance, Brio’s work over the past two decades appears all the more groundbreaking. Ethics, equity, and social justice are not always at the forefront of business, much less the world of finance. Brio has bravely gone against that tide, inspiring numerous others to do the same.

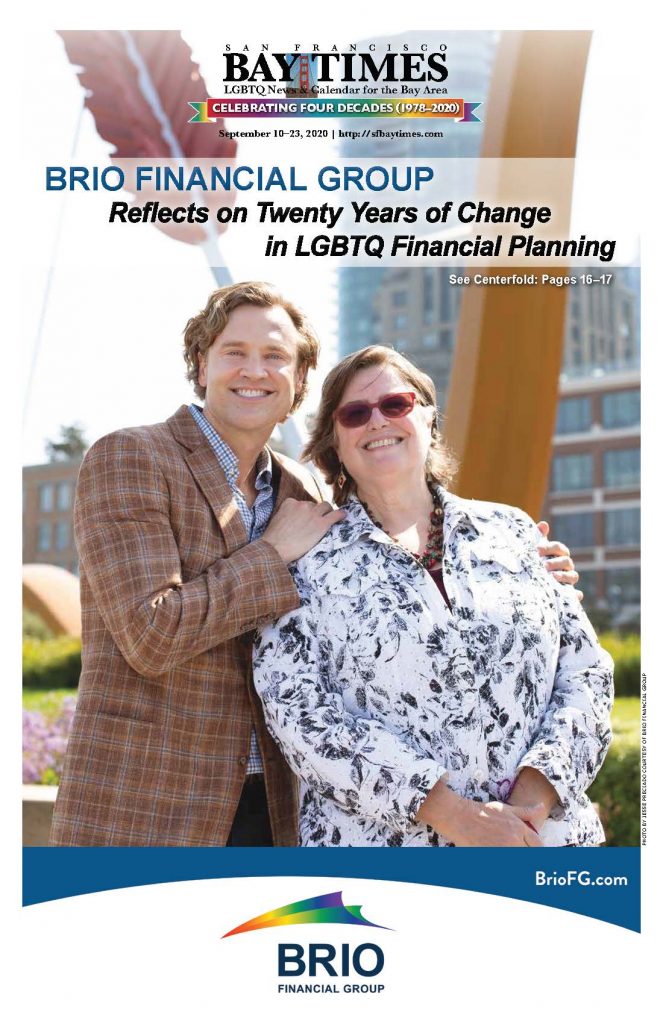

Brandon J. Miller, a Private Wealth Advisor/Founder at Brio, is a longtime columnist for the San Francisco Bay Times. His “Money Matters” column has provided readers with helpful information throughout the roller coaster of LGBTQ inequalities, unprecedented problems faced during this pandemic era, and more.

Miller co-founded Brio with Joanne Jordan, a former ICU nurse who, after many years, decided to leave health care to pursue another career. Shortly before her Brio retirement party in 2014, she told us, “I knew I wanted to do something that would challenge me and (so that I could) still work closely with people. It’s always been important to me to do something that helps others and, after much thought and soul searching, a career as a financial advisor was the perfect fit.”

Brio is now one of the nation’s largest independent private wealth firms. We congratulate Brio’s team on their success, including being selected as a finalist for the 2020 Excellence in Diversity & Inclusion Awards, and share the following recent interview with Miller and Jordan.

San Francisco Bay Times: How did you two first meet?

Joanne Jordan: We met at an American Express Financial Advisors (meeting) in ’99 and just liked each other. We had the same kind of philosophy and were similar in the way we approached our work and how we both really cared about people. We had kind of a “capitalist with a socialist heart” attitude. We wanted to help people and had similar values, so we really connected on that of level.

San Francisco Bay Times: What inspired you to launch your own financial group?

Joanne Jordan: We both wanted more flexibility and options than we could get within the employee structure. We wanted to call our own shots and it became more and more obvious that wasn’t going to happen unless we went out on our own.

Brandon Miller: We wanted the control to put clients first. It was clear very early on that we did not fit the financial advisor mold of straight, white, 60-year-old men from Topeka or wherever. In order for us to do what made sense for us, we had to do our own thing. We weren’t going to be able to play by the normal rules because we personally weren’t “normal.” Since the industry was not set up for LGBTQ people, we had to change our little, tiny little slice of it and figure out a way to make it more about our friends and clients, who weren’t “normal” either.

Joanne Jordan: So, in 2001, we wrote our mission statement and made the leap. It was really, really thrilling. Scary, but thrilling. When we got our first fax, we jumped around and literally ran down the hall going, “We’re getting a fax!”

San Francisco Bay Times: Was your firm always LGBTQ focused? Has that been an important part of your mission from the very beginning?

Brandon Miller: Yes, it has been. Back then, there wasn’t any kind of marriage equality. A big part of what we were always trying to do was to figure out what works for the gays, right? Especially from the legal, insurance, and tax perspective, there were hurdles. We had to learn all the rules and then figure out workarounds. Because of that, I think we ended up with a more academic focus than a lot of our peers. We had to approach financial planning more holistically.

Also, by virtue of being gay, we had a better understanding of what that meant for folks. Even something as simple as cash flow is different in Gayville because people handle their money differently when they’re not married. Plus, it was all of our friends who were the people who had faith in us to begin with. And so those were the people whom we had to figure out solutions for.

Joanne Jordan: It was also really important to me to work with women. When I was still a nurse, before I got into financial planning, I didn’t like the way I was treated as a woman in regard to my investments. I felt intimidated. So, I wanted to work with women to educate them and make sure they felt comfortable asking lots and lots of questions before making decisions. I think women make decisions differently than men. It’s a big reason why I wanted to go into the business in the first place. Not just to become a planner, but to work for gays and lesbians, and women in general.

San Francisco Bay Times: How did you go from being a nurse to a financial planner?

Joanne Jordan: I had been an intensive care nurse for 20 years and was ready for a change, so I started exploring different options. I knew I needed to work with people, helping people. I always liked finance and I love planning. So, I interviewed and got a job. It was one of the scariest—and best—decisions I ever made. In nursing in the hospital, repeat visits were not good. But when people came back to me in financial planning, they were getting financially healthier. I really liked how that was a flip.

San Francisco Bay Times: When you two first started your business, what challenges facing the LGBTQ community did you have to contend with?

Joanne Jordan: There was so much we couldn’t do because we couldn’t legally marry. Every single piece of planning was affected. Things many straight people take for granted needed to be addressed differently for our LGBTQ clients. First, when you’re gay, there is no pre-conceived path to follow, no “right” way to handle your money. I always told my straight clients the same thing: There’s no right way to do this; we need to find the right way for you. A lot of estate planning, like setting up wills and trusts, was very challenging and unique. And vital because nothing was going to just go to your spouse naturally by order of law. The whole parenting piece was huge. How do you adopt a child together, or if one partner is going to have the child, how will the other person have legal parental rights?

Brandon Miller: There were literally over a thousand different things that change when you can marry. But those were just the technical hurdles. There were also lifestyle things we had to navigate. Think about people who lost all their friends to AIDS. Or those who got disowned by their parents. Or people who are HIV+ positive and spent all their money before the cocktails came out, and now they might live for 40 more years! There were all kinds of different impacts that being part of the community allowed us to understand where our clients were coming from. We were going through the same issues and battles, the same fears or worries or whatever.

And that’s part of what builds trust. I think it’s also part of why we’ve been so successful for so long. We can relate to people whose life priorities are kind of different.

San Francisco Bay Times: How then did marriage equality change your approach?

Brandon Miller: We used to think of ourselves as this gay financial planning firm. Not that it was ever exclusively gay, but that was so much of the focus. Once there was marriage equality, we broadened our view, thinking of ourselves more as a firm for people who are nontraditional. Because basically, if you’re not straight and married with 2.4 children, you’re not traditional in the financial planning world.

San Francisco Bay Times: How else has your firm evolved over the years?

Joanne Jordan: We’ve certainly grown a lot over time, bringing on other advisors and creating this whole path for them within the firm. We’ve brought people in, had them start as an assistant, and helped to mentor them and educate them so they could move into different roles.

That was one of the pieces of our initial vision. The two of us sat down at the beginning and said, what do we want the firm to look like in 10 years, in 20 years? And, we’ve been pretty true to that vision, growing and mentoring and helping people, and incorporating charitable giving into our business.

Brandon Miller: And having a lot of fun along the way! That was part of the vision, too. You have a great point about the mentoring, JoJo. If you’re in this world where it’s all straight white males, how do you ever get diversity into the equation? I think we’ve always been really good about educating and mentoring and bringing up people who are not, frankly, straight white males. I don’t know how conscious it was in a certain way, but we’ve always done that from the very beginning. We’ve been willing to make sure that those are the people we’ve been nurturing and growing. And we’ve ended up with a much more diverse and better crew because of that.

I really think part of our strength as a company is, and always has been, that we have so many different world views. It really helps strengthen the advice that we’re able to give to people because we see it collectively through a lot of different lenses. The case strategy work that we always do together allows all of us to bring our own thoughts and viewpoints into the room to come up with the best possible solution for the client.

San Francisco Bay Times: Do you have any advice for other financial groups, or your industry as a whole, that could help them to achieve greater diversity and inclusion?

Brandon Miller: Well, clearly, we have a long way to go. Non-Hispanic whites make up 61% of the population, yet 86% of financial planners are white. Also 77% of financial planners are male. That’s a pretty big disconnect.

Joanne Jordan: As far as advice, it’s always an ongoing learning curve for people who are not different not to assume so much about others. I remember being at an industry conference and they asked how many people were married. I raised my hand and they came around and said, “Oh, what does your husband do?” I said, “Well, my spouse is female.” I would like people in other firms to be a little bit more cognizant and aware, to not make so many big assumptions. Especially because some people are not comfortable bringing it up. But if you ask questions in the right way, then people realize that they can bring it up. You can’t make assumptions about clients’ lifestyles if you’re going to create a plan that works for them.

San Francisco Bay Times: Brandon, in your column for this paper, you share valuable financial advice. Any tips for staying financially afloat and healthy during this pandemic and economic crisis?

Brandon Miller: Number one, wear a mask. That’s the healthy part.

Mostly we’re counseling clients to stay calm, this too will pass. If you’ve been laid off, file for unemployment right away. Spend within your means, which might be easier since we can’t travel or eat out these days. Or maybe you find eBay and Amazon too tempting. If you’ve had to dip into your cash reserve, build it back up as soon as you can. Keep the long-term picture in mind. If your investment plan is based on your goals and your goals haven’t changed, keep doing what you’re doing.

San Francisco Bay Times: Joanne, as a retiree, any advice for the rest of us?

Joanne Jordan: Retirement is the bomb! My best advice is to retire to something, not just from something. I’m still a part of Brio, even though I’m no longer there day to day. Brandon and I weren’t just business partners; we’re family and that continues. My relationship with Brio and everyone who works there is really important to me. I never saw it as a job. It was a calling, like nursing was a calling for me.

So, it feels really good to stay connected and involved and continue to build the culture that Brandon and I started when it was just the two of us.

San Francisco Bay Times: Your team has already achieved so much. What are your future plans and what goals would you still like to meet?

Brandon Miller: This is going to sound totally hokey, but I think about McDonald’s with their “over 100 gazillion served” sign. Brio is all about how many households can we impact. Onboarding more advisors means we can have more clients and help more people move further ahead in their lives, whatever that means to them. Because a lot of times it’s not just about having more money. Very rarely is that really the answer. The goal is trying to have more people achieving whatever their life dreams are. At the highest level, that’s what we care about.

And I see us continuing to grow because I think the way we approach money at Brio is really cool and different. For most financial firms, their primary focus is to accumulate money. Our primary focus will always be to make sure that people are living their best lives. If that means taking money away from us to go buy a vacation home, go do it. Maybe that’s a little bit of the gay thinking. That, and not ever taking ourselves too seriously.

For More Information

Brio: https://www.briofg.com/

2020 Excellence in Diversity & Inclusion: https://www.dandiin.com/

Photos courtesy of BRIO Financial

Money worries are natural during this pandemic and economic crisis, but Brandon Miller, private wealth advisor, a founder of Brio Financial Group, and a San Francisco Bay Times columnist, has some suggestions.

1. Wear a mask. Stay healthy so you can actually enjoy your money.

2. File for unemployment if you get laid off. Don’t let pride get in your way.

3. Spend within your means. If you’re earning less now, figure out ways to spend less.

4. If you’ve dipped into your cash reserve, build it back up as soon as you can.

5. Keep the long-term in mind. If your investment plan is based on your goals and your goals haven’t changed, keep doing what you’re doing.

Published on September 10, 2020

Recent Comments