Last year’s housing market was defined by two key things: inflation and rapidly rising mortgage rates.

The Federal Reserve’s efforts to lower inflation by raising interest rates has caused mortgage rates to more than double – something that’s never happened before in a calendar year. This had a cascading impact on buyer activity, the balance between supply and demand and ultimately home prices. With all these changes some buyers and sellers put their plans on hold and decided to wait until the market feels a bit more predictable.

But what does that mean for the market in 2023?

It appears that the Fed’s efforts have had a small effect on inflation and if

that holds, it is likely that they will slow down increasing the base interest

rate and we will see an easing off of mortgage rates. From what can be

read online, there is an expectation that mortgage rates will decrease as

the year progresses but maybe only about a half point lower. There will be a lot of volatility around mortgage rates. So if the Fed’s efforts lower inflation, we will have lower mortgage rates and this will lead to a stronger housing market.

The median price of single-family homes in 2022 ended up dropping about 10-12% year over year, bringing prices back down to under pre-pandemic numbers. Unit sales have dropped about 30-40% with a corresponding increase in inventory. Buyers have had the opportunity to scrutinize options more, and smart sellers have priced homes to sell. Fannie Mae and Freddie Mac have increased loan limits on the conforming loans and this will also help buyers succeed in the market.

As in every market, homes with the best locations will do well, bucking market trends. Homes that need work, have challenging floor plans, or are on the fringe of less desirable neighborhoods will offer more opportunities for savvy buyers. It really looks like the trend for the start of 2023 will be a calmer, more buyer friendly market. We are past the big boom of the past two years, and there is an expectation of a more stable market overall with single-family homes still being in the biggest demand.

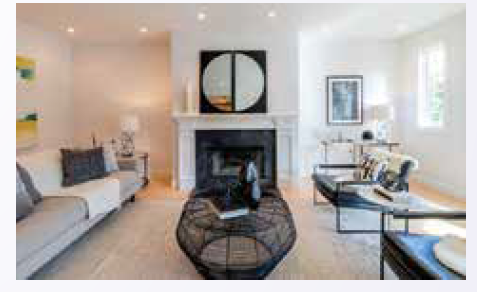

If you are thinking of selling in this market, you will need to prep your home to appeal to the broadest base of buyers. The strongest buyers are looking for homes that they can just move into; they do not really want to do renovations. Locations that have shops and restaurants close at hand and nearby transportation are the best. You cannot necessarily fix a floorplan issue, but you can, through the use of staging, make a home look more functional and inviting. Also, price your home to sell. Inflated prices

will cause a property to linger on the market and cause it to sell below market in the long run.

If you are thinking of buying, get your finances in order. Buyers that are fully underwritten are in the strongest position to succeed. Also, consider taking on projects that others might feel are too much trouble. A home needing new paint, counters or a freshened bath won’t get the same activity and could be an opportunity for a savvy buyer. In all cases, find a realtor who knows their way around the City and has ideas on what can be done to improve the value of a home with the least amount of effort and cost.

146 Lower Terrace

Corona Heights 3 bedroom,

3 bathroom, 2 level

Condominium

Castro Village, Victorian condo with open living, dining & kitchen space. 2 beds, 2 ba main fl, one en-suite. 1 bed (or den) lower level + bath. Two car tandem parking, storage, laundry area. Two private gardens/patios. Easy access to Castro or Cole Valley, MUNI, tech shuttles, shops & restaurants.

$1,749,000

http://www.146LowerTerr.com

Listed by Steve Gallagher

DRD#01193002

Coldwell Banker

Real Estate in 2023

Published on January 12, 2023

Recent Comments